Decoding the Fed Rate Cut | What It REALLY Means for Your Mortgage in India

Okay, let’s be honest. The news about the Federal Reserve (the Fed) possibly cutting interest rates sends ripples across the globe, doesn’t it? But what does a bunch of American bankers fiddling with rates have to do with your EMI payments here in India? More than you might think. That’s what we’re diving into today. Forget the jargon; we’re going to break this down so you can actually understand fed rate cut mortgage interest rates and how it impacts you.

Why Should Indians Care About the Fed Rate Cut?

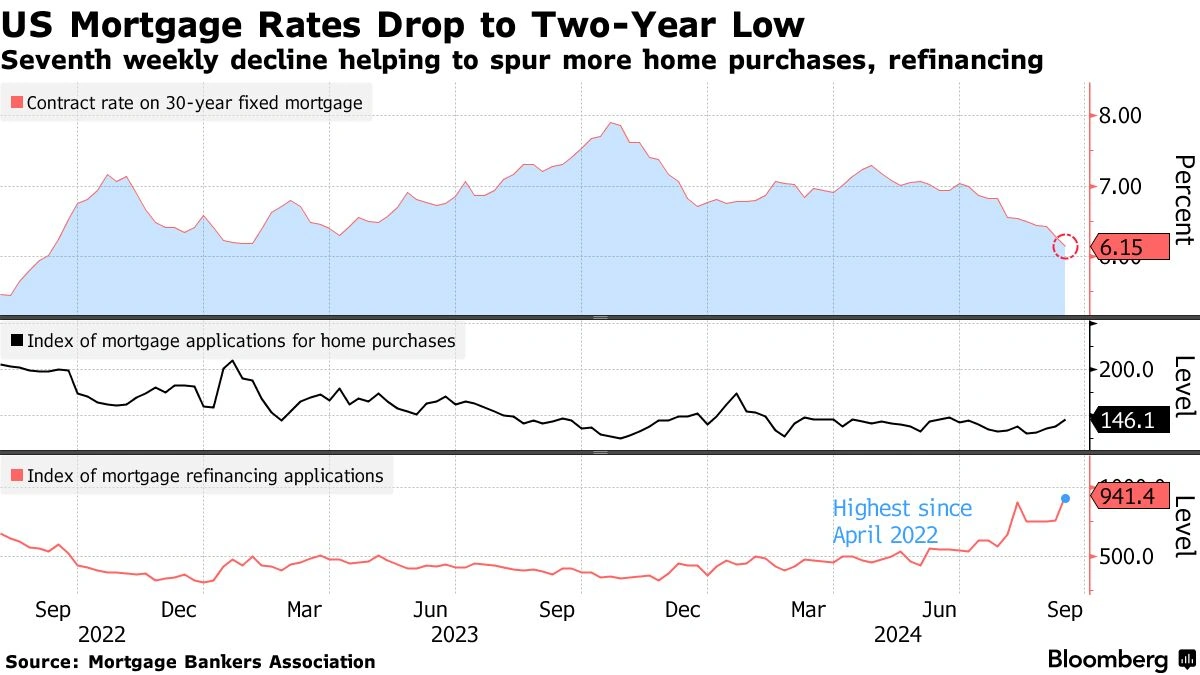

Here’s the thing: the global economy is interconnected. The Fed’s decisions, specifically regarding the federal funds rate , influence global financial markets. When the Fed cuts rates, it generally weakens the US dollar. A weaker dollar can lead to increased investment in emerging markets like India. Think of it like this: investors are always looking for the best returns. If the US offers less, they start looking elsewhere. “Elsewhere” often includes India. But why does that matter for your mortgage rates ?

Well, increased investment inflows can lead to a stronger Indian rupee and potentially lower borrowing costs in India. The Reserve Bank of India (RBI), our own central bank, keeps a close eye on what the Fed is doing. While the RBI makes independent decisions, it’s influenced by global trends. A Fed rate cut gives the RBI more wiggle room to potentially lower rates in India without causing massive capital outflows. This, in turn, could translate to lower home loan interest rates .

The Ripple Effect | How the Fed Impacts Indian Home Loans

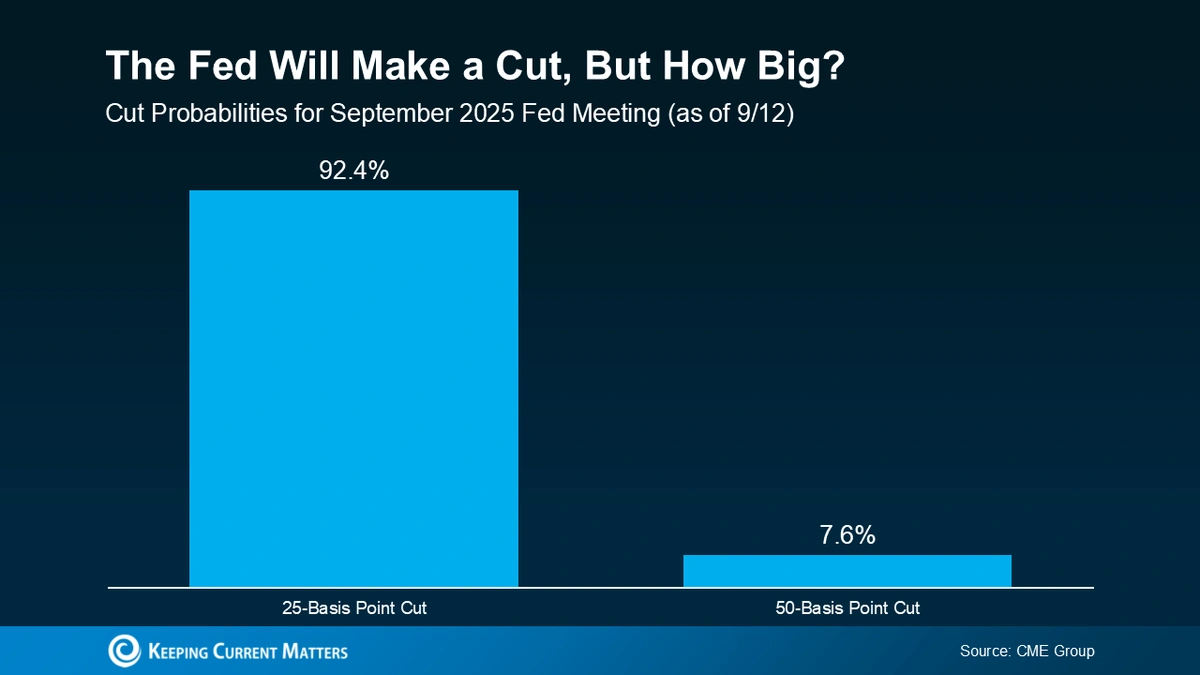

So, how exactly does this happen? It’s not as simple as the Fed announcing a cut and Indian banks immediately slashing rates. There are several steps in between. I initially thought this was straightforward, but then I realized… it’s not. Let me rephrase that for clarity. Increased foreign investment puts downward pressure on Indian government bond yields. Banks use these yields as a benchmark for pricing their loans. Lower yields, in theory, should lead to lower lending rates. But, and this is a big but, banks also consider other factors like their own cost of funds, the overall economic climate, and the demand for credit.

A common mistake I see people make is assuming a direct, one-to-one relationship. It’s more like a complex dance. The Indian economy , global events, and the RBI’s policies all play a role. The Fed rate cut is just one piece of the puzzle. According to experts at theInvestopedia, there’s always a lag effect.

What About Inflation? The Real Wild Card

Here’s where things get interesting. Inflation. It’s the elephant in the room that nobody wants to talk about. If inflation is high in India, the RBI is less likely to cut rates, even if the Fed does. High inflation erodes the value of money and makes it harder for people to afford things. The RBI’s primary mandate is to control inflation. So, if inflation remains stubbornly high, don’t expect significant cuts in mortgage interest rates , regardless of what the Fed does.

And, the one thing you absolutely must double-check is how your loan agreement handles rate changes. Is it a fixed rate or a floating rate? If it’s a floating rate, it’s linked to a benchmark, and that benchmark’s movement will determine how your EMI changes. If it’s fixed, you’re locked in (for better or worse) for the term of the loan.

Navigating the Uncertainty | What Should You Do?

So, what’s the takeaway for you, the Indian homeowner or aspiring homeowner? Don’t panic! The Fed rate cut is a positive signal, but it’s not a guarantee of lower mortgage rates. Keep a close eye on Indian inflation data and the RBI’s policy announcements. Shop around for the best rates. Talk to different banks and compare their offers. Consider your own financial situation carefully. Can you afford the loan even if rates go up? Can you realistically handle rising EMIs ?

Also, remember that buying a home is a long-term decision. Don’t make it solely based on short-term interest rate fluctuations. Focus on finding a home that you love and that fits your budget. Secure your future with a plan that works in both good and bad economic situations.

FAQ | Your Burning Questions Answered

Frequently Asked Questions (FAQ)

Will a Fed rate cut definitely lower my home loan interest rate?

Not definitely. It increases the likelihood of lower rates, but the RBI and individual banks make their own decisions based on a variety of factors, including inflation and overall economic conditions.

How long does it take for a Fed rate cut to impact Indian mortgage rates?

There’s no set timeline. It can take several weeks or even months for the effects to trickle down to Indian banks and for them to adjust their lending rates.

What if I have a fixed-rate home loan?

A Fed rate cut won’t directly impact your interest rate. You’re locked in at the agreed-upon rate for the duration of your fixed-rate period.

Should I wait to buy a home in India until the Fed cuts rates?

That depends on your individual circumstances. Waiting might result in slightly lower rates, but consider your long-term goals and housing needs first.

Are there any risks associated with lower interest rates?

Potentially. Artificially low rates can sometimes fuel asset bubbles and lead to unsustainable economic growth. However, moderate rate cuts are generally considered beneficial.

So, there you have it. The Fed rate cut and its potential impact on your Indian mortgage – demystified. Remember, it’s not a magic bullet, but it’s a factor to watch. Now, go forth and make informed decisions! What fascinates me is how interconnected our world is – it is interesting to see how even something happening in the USA can affect us.